PROWEIN BUSINESS REPORT 2019

THE MOST IMPORTANT ISSUES

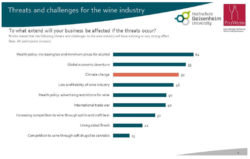

Current Challenges

Effects along supply chain

Effects on production

Vailability, prices and qualities

Effects on consumer demands

Importance of sustainability